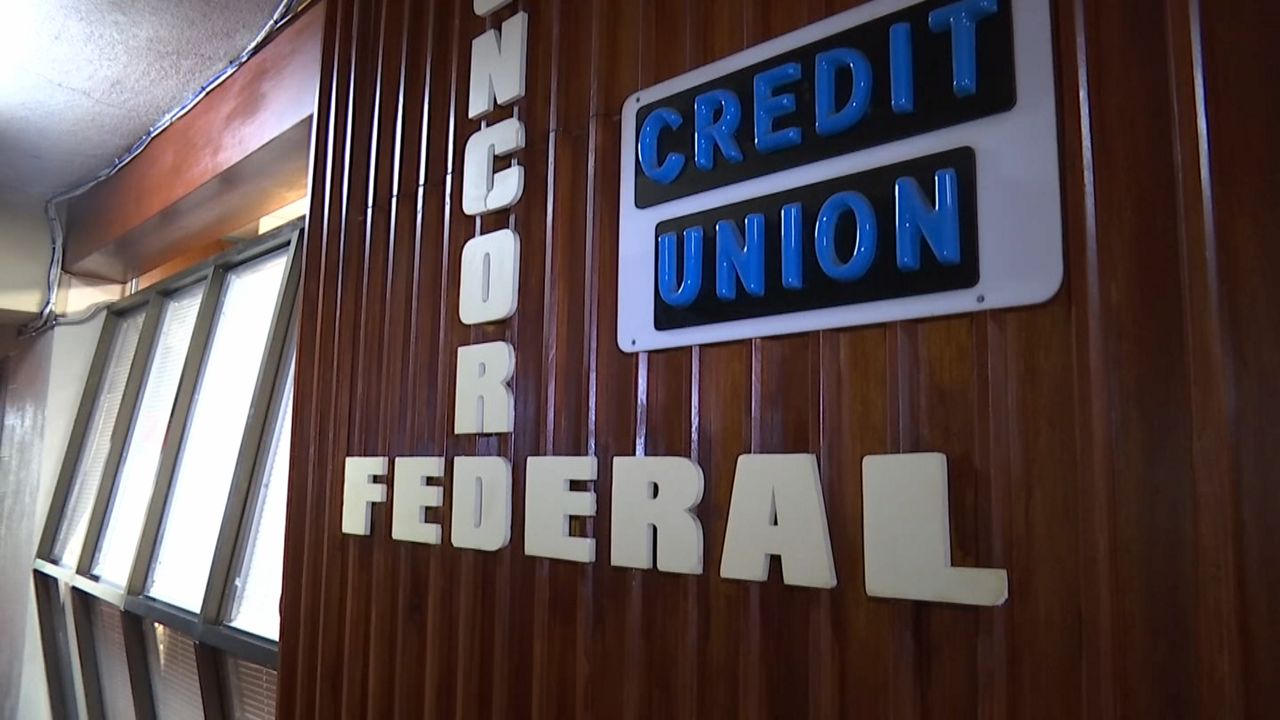

Concord Baptist Church of Christ takes up the corner of Marcy Ave and Madison Street. But open the side door to the church, go down one flight, and there’s Concord Federal Credit Union, serving Bedford- Stuyvesant residents since 1951.

“Our members couldn’t go and get loans or start accounts without a lot of red tape and a lot of bureaucracy and sometimes being denied. They said, ‘Let’s just pool our resources. Let’s start our own institution where we could go,’” says Ronnie Brandon, President of Concord Federal Credit Union.

The credit union is a nonprofit financial services organization where members are shareholders, join for only $1, can maintain as little as $25 in their accounts and don’t incur any fees or penalties.

“You owe $39 for a late charge? What kind of nonsense is that? I could start another one of my grandchildren‘s accounts at $39, less than $39,” says Concord Federal Credit Union member Mable Robertson.

Now the credit union has joined forces with the Bedford-Stuyvesant Restoration Corporation to provide financial counseling to its members. It’s an effort to empower the long-standing black community as the neighborhood faces gentrification.

“We could close the racial wealth gap in Central Brooklyn by offering them safe, transparent, fair and affordable financial products, coupled with the financial counseling. We believe that will create more opportunities for prosperity in Central Brooklyn,” says John Edward Dallas, Senior Financial Counselor with Bedford-Stuyvesant Restoration Corporation.

Their partnership is backed by Citi Community Development and the nonprofit group Inclusiv, which has said that one minority run credit union closes every week in the US. They created the African American Credit Union Initiative to offer tech development and support among other services.

“Inclusiv and Citi Community Development work together to create CU impact which is a shared technology platform, basically the core operating system for credit unions so that they don’t have to put time and energy and money into developing their own technology platform,” says Greg Schiefelbein, New York Tri-State Director at Citi Community Development.

The support has allowed Concord to expand their business hours to more than just two days a week.

To help boost their offerings the credit union just launched online banking.

With all the new initiatives, the credit union expects to grow, which in turn benefits the community.

“We share the proceeds of those returns with the membership,” says Brandon.

This Brooklyn corner is strengthening the community spiritually and financially.

Brooklyn Church Serves the Community Spiritually and Financially

PUBLISHED April 24, 2019 @11:15 PM