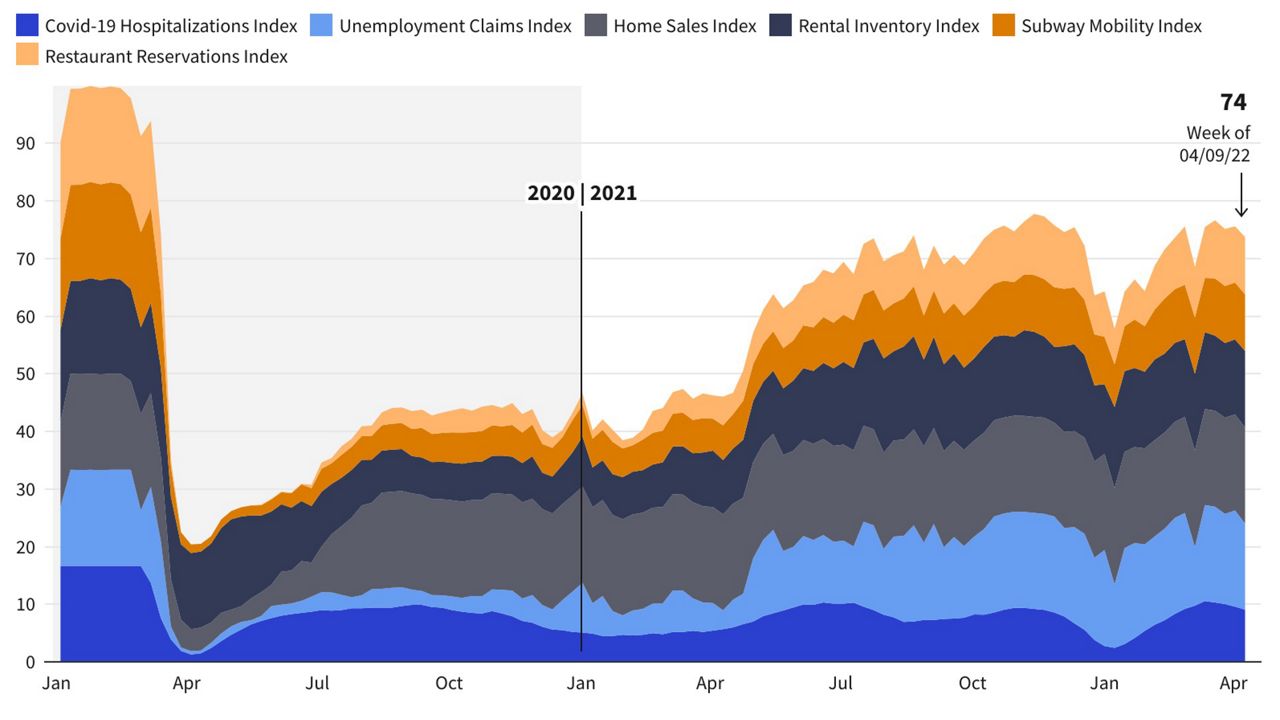

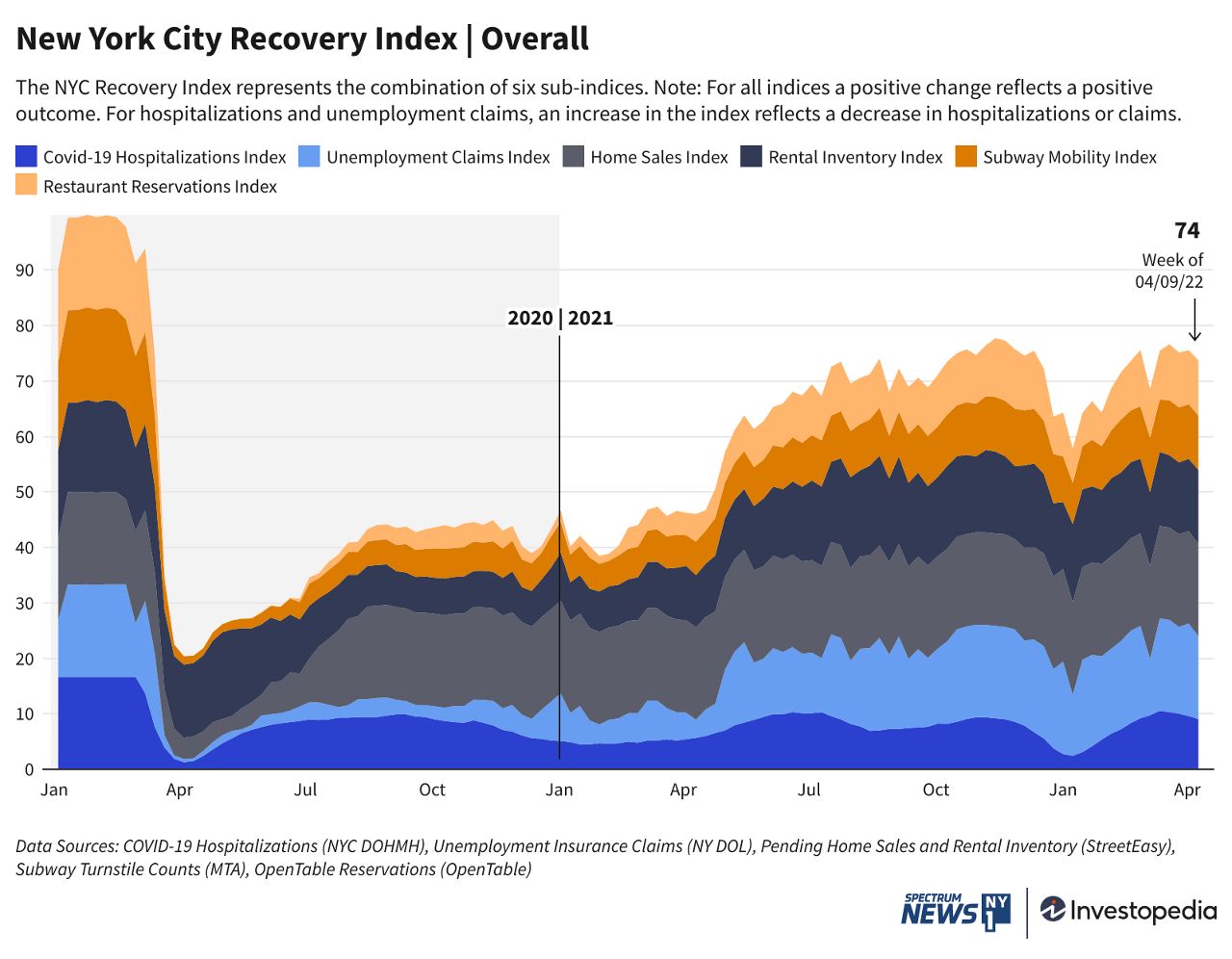

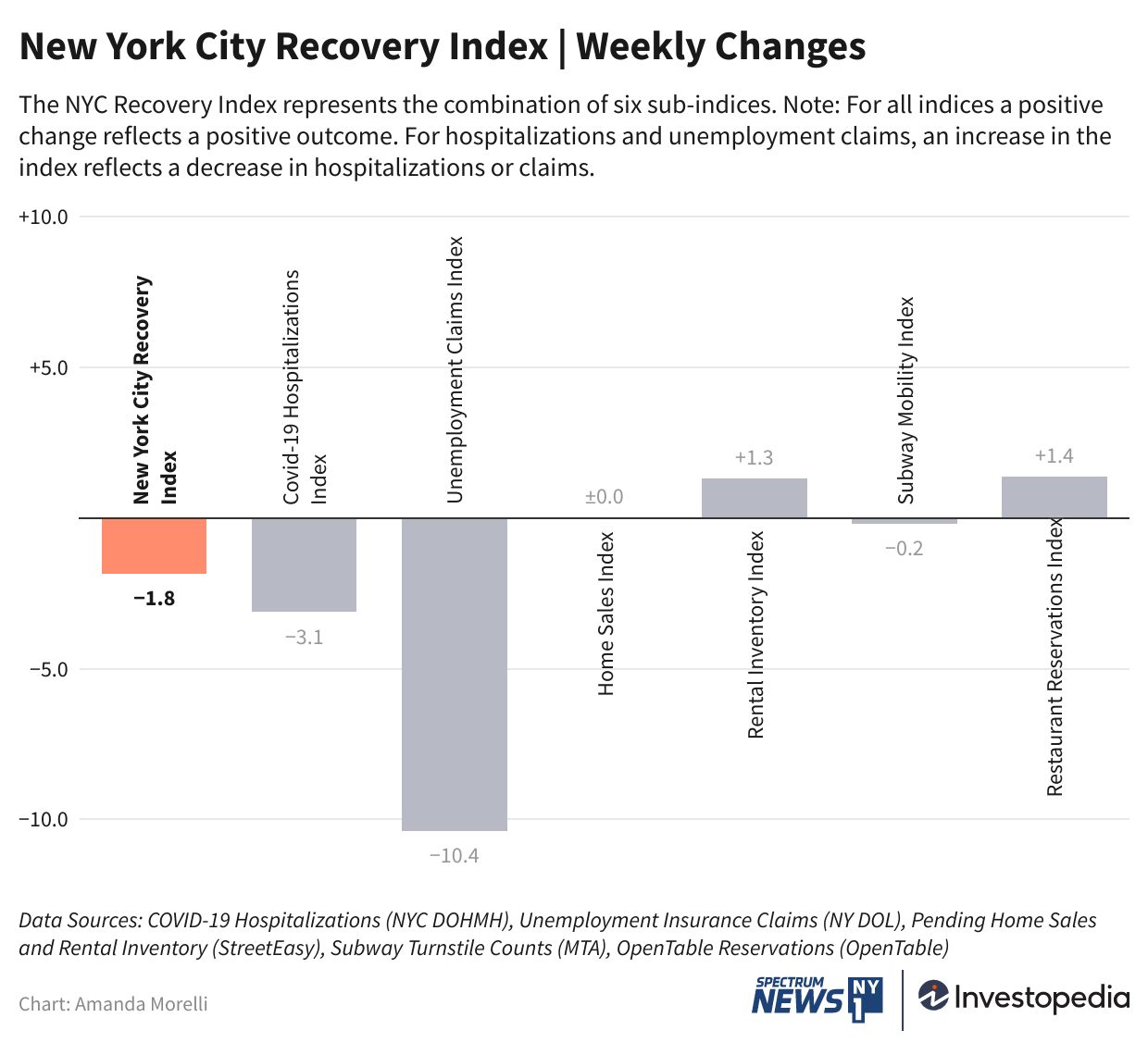

New York City’s economic recovery index fell during the week ending April 9, 2022, with a decline from 76 to 74 points. Positive contributions came from rising home sales and rental vacancies, as well as an increase in restaurant reservations. However, a sharp rise in unemployment insurance (UI) claims and COVID-19 hospitalization rates weighed on the index, holding it back from posting greater gains. Subway ridership also declined compared to the previous week.

Despite a federal court ruling in Florida overturning mask mandates, New York City officials have kept mask mandates in place for the city’s public transportation services. The Metropolitan Transportation Authority (MTA), which falls under state jurisdiction, has kept mandates in place for city buses, subways, and commuter trains, as advised by Governor Kathy Hochul.

Meanwhile, the Port Authority of New York and New Jersey has lifted mask requirements at Newark Liberty International Airport, with mandates remaining in place at LaGuardia and John F. Kennedy International Airports. COVID-19 infection rates have declined substantially since the peak of the omicron wave in January, however cases have been on an upward trend in New York and other states in recent weeks.

New York City’s recovery stands at a score of 74 out of 100, according to the New York City Recovery Index, a joint project between Investopedia and NY1. Just over two years into the pandemic, New York City’s economic recovery is just under three-quarters of the way back to pre-pandemic levels.

COVID-19 Hospitalizations Climb

COVID-19 hospitalization rates rose for the fourth consecutive week as infection rates have trended upward throughout the New York region. The hospitalization rate rose to 38 hospitalizations daily, over eight more than the past week’s rate. The trailing seven-day average is now over double the post-omicron low of 18 daily hospitalizations recorded on March 12. However, the current rate is still low compared to previous pandemic highs, and roughly matches the rates in mid-November.

Regarding new infections, the CDC continues to project that 100% of new cases in the New York region (which ecompasses New York, New Jersey, Puerto Rico, and the U.S. Virgin Islands) are attributable to the omicron variant. A new, rapidly-growing strain labeled BA.2.12.1 now accounts for 52.3% of new cases, compared to the older BA.2 strain which comprised 45.7% of new infections this week. As of April 18, 77.9% of New York City residents have been fully immunized against COVID-19, according to NYC Health data. Since the onset of the pandemic over two years ago, over 2.3 million cases and over 40,000 deaths have been recorded in New York City.

Unemployment Claims Rise Sharply

Unemployment insurance (UI) claims rose considerably in the week ending April 9, increasing by 690 claims from 5,120 to 5,810. This compares to a modest decline of 33 claims for the pre-pandemic rolling average of claims, tracking the equivalent week of 2019. The recent increase has put the rolling average of UI claims 11.6% above the 2019 level. However, the UI claims subindex remains at a healthy score of 90 out of 100. The ongoing economic recovery and tight labor market could put downward pressure on claims in the weeks ahead.

Breaking down this week’s UI claims by borough, Manhattan and Queens bore the brunt of the recent increase. Manhattan’s share of new claims rose slightly to 17.90%, up from 17.38%, while that of Queens rose to 25.65% from 24.80%. Brooklyn, the Bronx, and Staten Island all witnessed their respective shares shrink. Brooklyn’s share of claims declined to 29.95%, while Staten Island and the Bronx fell to 5.34% and 21.17%, respectively.

Home Sales Surge

Pending home sales in the city rose by 70 sales in the week ending April 9, reversing the decline from the prior week and marking a bright spot in this week’s report. Weekly sales increased from 723 to 793, with sales 76% higher than the pre-pandemic level. By borough, Brooklyn sales are 94.5% above the 2019 average, followed by Manhattan and Queens at 77.3% and 41.5%, respectively. The outlook for home sales remains strong, although sales may subside over coming weeks as rising mortgage rates impact consumer demand.

Rental Availability Increases

Rental vacancies totaled 13,518 in the week ending April 9, recording an increase of 411 residences from the previous week. The increase put the rental vacancies subindex at a score of 80 out of 100. The rental vacancy rate is now increasing at a rate slightly above the seasonal average for New York City. Total rental availability, however, remains several thousand units below the pre-pandemic level, and would require several weeks of consecutive increases to return.

Subway Ridership Declines Again

Subway ridership declined for the second consecutive week, with ridership remaining 41.1% below pre-pandemic levels, as indicated by the trailing seven-day average. For the week ending April 9, the MTA reported a trailing seven-day average of 2.87 million riders. In a discouraging sign for the city’s subway, ridership appears to have plateaued at a level similar to the pre-omicron average of November 2021. Note, this week’s report does not reflect data on changes in ridership following an April 12 shooting on the NYC subway system.

Restaurant Reservations Rebound

Reservations at the city’s restaurants and dining establishments recorded an increase in the week ending April 9. The restaurant reservations subindex is now 40.14% below the pre-pandemic level, compared with 41.5% below 2019 levels the week prior. Total reservations roughly match rates from two weeks ago, after a decline during the week of April 2. The arrival of warmer weather over upcoming weeks, as springtime gets fully underway, may be a positive sign for outdoor dining and the city’s restaurant industry at large.

To get more news and information from this partner, subscribe here.