Despite broad bipartisan support, legislation to boost U.S. competition and innovation continues to languish in Congress as an unofficial deadline looms.

What You Need To Know

- Despite broad bipartisan support, legislation to boost U.S. competition and innovation continues to languish in Congress as an unofficial deadline looms

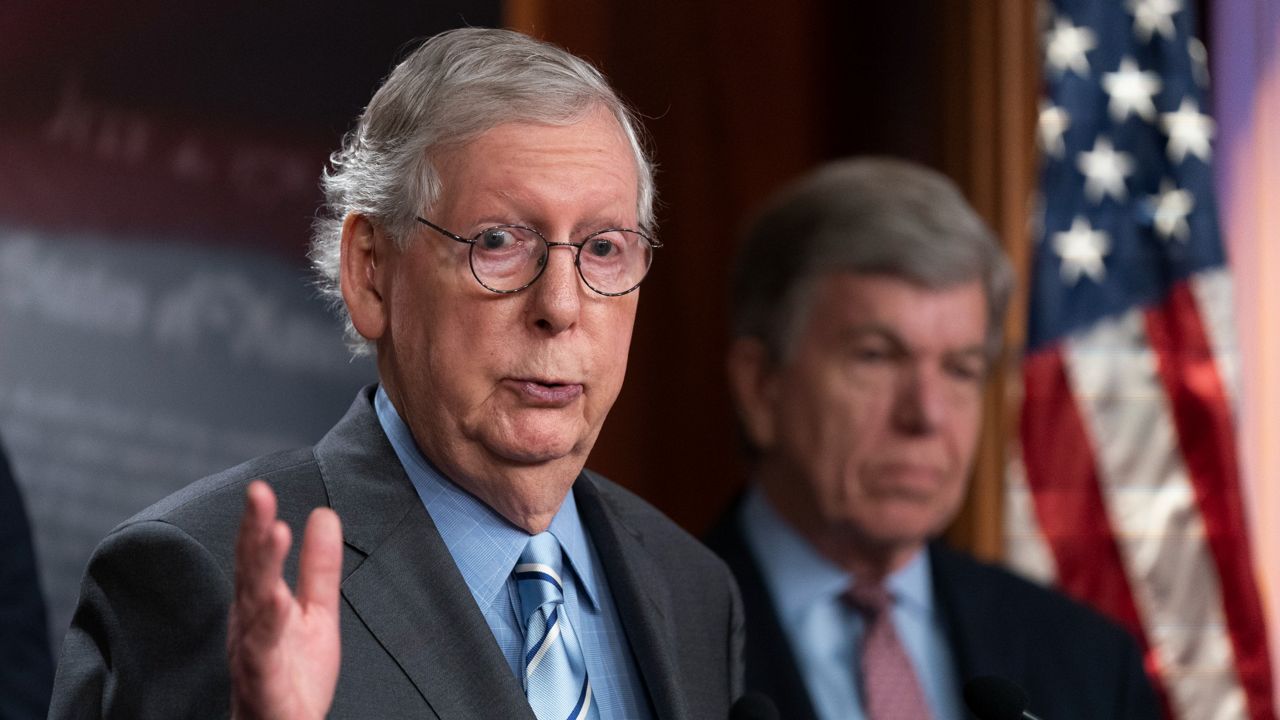

- On Tuesday, Senate Minority Leader Mitch McConnell softened his threat to block a bipartisan deal if Democrats continue to pursue a major social and climate spending bill

- Intel CEO Patrick Gelsinger said he might delay development of a $20 billion semiconductor manufacturing facility in Ohio if Congress does not soon approve billions of dollars in subsidies for his industry

- The Senate and House have passed separate bills, and lawmakers have been negotiating toward compromise legislation

On Tuesday, Senate Minority Leader Mitch McConnell softened his threat to block a bipartisan deal if Democrats continue to pursue a major social and climate spending bill. Meanwhile, Intel CEO Patrick Gelsinger said he might delay development of a $20 billion semiconductor manufacturing facility in Ohio if Congress does not soon approve billions of dollars in subsidies for his industry.

The Senate passed its $250 billion U.S. Innovation and Competition Act, or USICA, in June 2021 by a 68-32 vote. The bill includes $52 billion to incentivize more companies to build factories in the U.S.

In February, the House approved its own version, called the American Competes Act — a $350 billion plan. That legislation passed largely on party lines.

Both bills aim to make the U.S. more competitive against China and strengthen domestic supply chains by investing in the chip industry.

Semiconductors help power many products, including smartphones, televisions, home appliances and vehicles. They also play a key role in national security because they are used in items such as military telecommunications equipment, fighter planes and cruise missiles.

After years of heavy reliance on Asia for the production of computer chips, vulnerability to shortages of the crucial components has been exposed in the U.S. and Europe as they’ve emerged economically from the pandemic, contributing to decades-high inflation.

Senate and House lawmakers have been negotiating toward compromise legislation, as their bills differ on how to improve research and development, whether to expedite visas for skilled foreign citizens, and how to protect U.S. research from foreign interference.

Some have set Congress’ August recess as the unofficial deadline to complete a deal. But McConnell, R-Ky., poured doubt on the talks last month by tweeting, “Let me be perfectly clear: there will be no bipartisan USICA as long as Democrats are pursuing a partisan reconciliation bill.”

The Senate Republican leader was referring to negotiations among Democrats, namely Majority Leader Chuck Schumer of New York and Sen. Joe Manchin of West Virginia, on a spending bill that could pass without Republican support. While the details of the package are still being hammered out, it is expected to include energy tax credits, prescription drug price relief and deficit reduction as well as tax hikes on businesses and wealthy individuals.

The White House responded to McConnell’s threat by accusing him of “holding hostage a bipartisan package to strengthen American competitiveness versus China, that would yield hundreds of thousands of manufacturing jobs in places like Southern Ohio, Idaho, and other states around the country.”

While McConnell hasn’t completely backed down, he did offer alternatives Tuesday, saying the House could approve the Senate-passed legislation without amendments or lawmakers could propose the $52 billion in subsidies for chip makers in a standalone bill.

“The conference is stuck,” McConnell told reporters. “And so it seems to me there are a couple of ways out of this, potentially."

In an interview with Spectrum News on Wednesday, Cecilia Rouse, chair of the White House Council of Economic Advisers, said the bills are very important in increasing the United States’ economic capacity.

“They go to helping us make our economy more productive, which helps us address challenges such as Russia's war against Ukraine, challenges such inflation,” she said. “It helps us address those policies and face those those challenges and maintain economic health going forward as well. So we call on Congress to do the right thing.”

In an interview with Washington Post Live on Tuesday, Intel’s Gelsinger said he will “make a decision to delay our project in Ohio if” a chip subsidy bill “doesn’t pass.”

"There are real‑time consequences if this doesn't pass," he said.

Intel announced in January its plans to invest more than $20 billion in building two new chip factories on a nearly 1,000-acre site in Licking County, just outside Columbus. The initial phase of the project is expected to create 3,000 full-time jobs and 7,000 construction jobs, the tech company said.

Commerce Secretary Gina Raimondo told CNBC last month that Taiwan-based semiconductor company GlobalWafers might not follow through on its plans to build a factory in Sherman, Texas, if Congress doesn’t approve the incentives for chip production.

“This investment that they’re making is contingent upon Congress passing” the funding, she said. “The CEO told me that herself.”

Sanjay Mehrotra, president and CEO of Micron, a computer memory and data storage company, told Fox News on Monday the public funding is needed to level the playing field with countries whose governments have invested heavily in semiconductor manufacturing for more than 20 years.

The U.S. share of the worldwide chip manufacturing market has declined from 37% in 1990 to 12% today, according to the Semiconductor Industry Association.

“We need to get it (the legislation) across the finish line for jobs, for the resilient domestic supply chain here in the U.S. and, of course, at the same time, (for) economic security, but also national security,” Mehrotra said.