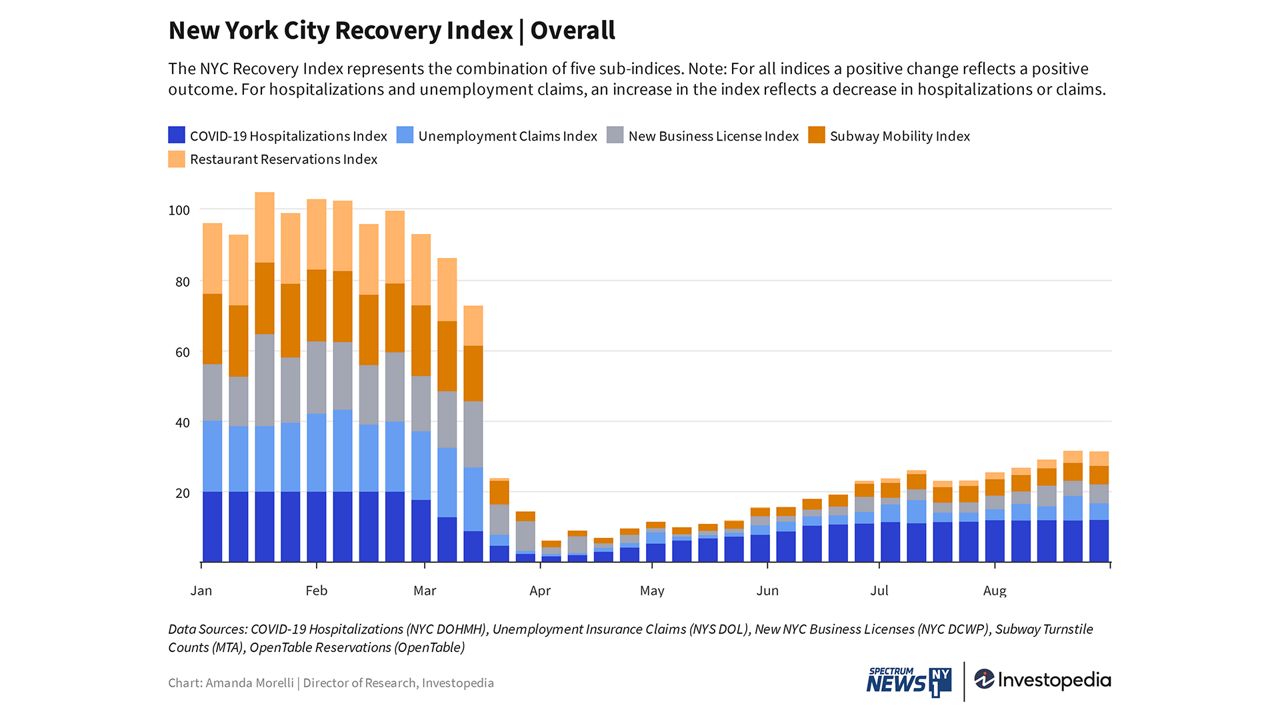

A slight rise in weekly unemployment claims stalled New York City’s economic recovery in the past week, despite gains in other measures we're tracking as part of the NYC Recovery Index. As summer came to an unofficial end with Labor Day weekend, small businesses, particularly restaurants, saw more activity, but persistently high levels of unemployment continue to threaten the recovery.

The overall Recovery Index weekly score fell 0.2%, dragged down by those unemployment figures which reflect the fact that New York City has among the highest joblessness rate of any city in the country.

Unemployment Claims Rise

Initial unemployment claims (people filing for unemployment for the first time) topped 35,196 for the week of August 29. That’s 1,151 higher than the prior week, and 28,465 people higher or 423% than the same week a year ago. More than six months into the pandemic, New Yorkers continue to lose their jobs at an alarming rate on a weekly basis.

COVID-19 Hospitalizations Decrease

New hospitalizations related to COVID-19 continue to decrease, and New York City has stayed below the 1% new infection rate for a straight month. That’s very encouraging and will be a large factor in the city’s eventual economic recovery. The true test will be in the coming weeks, as New York City public school in-person openings have been postponed until September 21. That delayed opening may have kept some residents from returning to the city in the past two weeks as other economic indicators remain depressed.

Restaurant Reservations Slowly Increase

Restaurant reservations, as reported by OpenTable, continue to increase, albeit slowly. That won’t change until New York City is allowed to open for partial indoor dining. Government officials have indicated that there is no timetable for that, even though Westchester County and Long Island both introduced indoor dining at 50% with tables separated by six feet back in June, and New Jersey permitted 25% capacity indoor dining last weekend. That is putting intense pressure on the restaurant industry, which employed as many as 300,000 at the beginning of the year. More than half of those jobs have been lost since then. The 10,000 New York City restaurants that are operating with outdoor seating and curbside pick-up and delivery are operating at 30% of their 2019 capacity, according to the New York City Hospitality Alliance.

Small Business Openings Rise

Applications for new small businesses spiked last week after declining two weeks prior. These numbers fluctuate heavily on a weekly basis, and studying the data for the past several months has revealed that most of these applications are for single-employee businesses or small national franchises. While these businesses are important to the individuals starting them, and a vibrant part of the city’s economy, we will be retiring this indicator from our index going forward, and replacing it with real estate data. We believe that real estate data is an indicator that impacts nearly all New Yorkers. It is a larger contributor to the city’s tax revenue, and it tells us whether people are moving into or leaving New York City amid the pandemic.

Subway Mobility Holds Steady

Subway usage remains nearly 70% pre-pandemic levels, but is expected to rise post Labor Day as many residents return to New York. The gains will be subdued as public schools have delayed their in-person start date until September 21 to allow for more virus testing. Commuter traffic into the city should also remain at subdued levels, as many businesses have yet to reopen their offices and millions of people are still working from home.

To get more news and information from this partner, subscribe here.